Our Company

KRC is an international real estate investment group focused on acquiring, developing, and operating multi-family, Build-to-Rent (‘BTR’), and other opportunistic property assets.

INVESTMENT STRATEGY

KRC acquires multi-family assets and develops BTR assets with an aim of creating sufficient scale and presence in specific sub-markets to generate sustainable cashflows and consistent returns on invested capital.

-

Our Focus

We acquire, develop, and operate multifamily, BTR, and other opportunistic properties across the United States.

-

Our Approach

We identify and invest in markets with strong demographics in growth areas which attracts tenants with inbound industrial investment and innovation.

-

Our Portfolio

We cater to the needs of each market with a focus on creating and maintaining operational synergy across our core assets.

-

Our Network

We use a network of partners to identify and seamlessly complete transactions in multiple markets.

-

Our Team

We are composed of seasoned investment professionals with a global perspective and a diverse background.

SELECTIVE CASE STUDIES

KRC Columbia Portfolio

KRC Foxfire, KRC Quail Hollow, KRC Wildewood, KRC West Winds

KRC acquired four properties in Columbia, South Carolina in 2017 and 2018 in a series of transactions to develop sufficient scale in a sub-market lacking of institutional investors. This presented an attractive opportunity for a value-add investment by stabilizing operations and making capital improvements. We were successful in improving this portfolio’s NOI over 60% by maintaining strong YoY revenue growth of over 8% and keeping expenses low. This resulted in an exit to an institutional purchaser at the end of 2021.

- Realized IRR: Over 25%

- Equity Multiple: 2.3x in 4 years

- Acquisition date: 2017-2018

- Sale Date: December 2021

- Units: 667

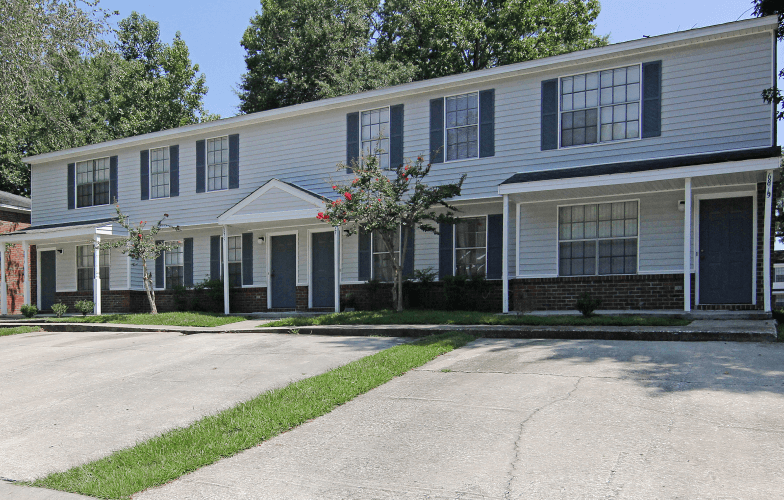

KRC Ridge

4565 Covington Hwy Decatur, GA 30035KRC purchased this 216-unit multifamily townhome community in Atlanta, Georgia in early 2012. The principals were able to leverage market conditions to acquire this high potential asset below replacement value. We invested over $500,000 in capital improvement to enhance the physical characteristics of the property through a detailed renovation program. This allowed the asset to increase its average market rent, improve the tenant base, and reduce operating expenses. Once stabilized, we refinanced the short-term debt into long-term fixed-interest rate debt. This refinance unlocked over $1.7 million in net proceeds, which was distributed to our investors as equity repatriation. Taking advantage of the low cap rate environment in late 2021, we marketed and sold the asset to a local investor looking to grow their Atlanta portfolio. The sale concluded in early 2022.

- Realized IRR: 40%

- Equity Multiple: 10.4x

- Acquisition Date: January 2012

- Sale Date: February 2022

- Units: 216

Recent Updates

Berkeley Homes

by King Rook Capital

121 Marigny Street, Moncks Corner, SC 29461

Berkeley Homes by King Rook Capital is a newly constructed state-of-the-art build-for-rent townhome community built from the ground up in conjunction with a leading local developer in Moncks Corner, South Carolina. This ambitious project is a welcome complement to our existing portfolio in Charleston, and it is now a thriving community providing much needed housing for the local community and military service members.

- Acquisition Date: July 2022

- Completion Date: May 2023

- Units: 114

All rights reserved King Rook Capital 2023

Design & Developed By Cydomedia